PH RS-5 2012-2026 free printable template

Show details

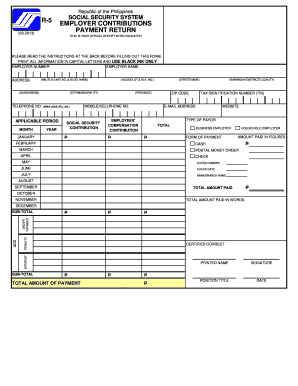

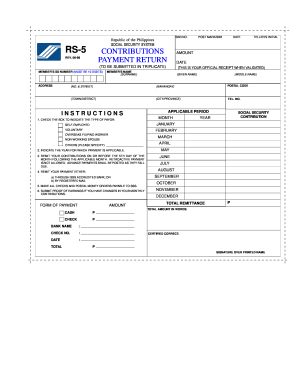

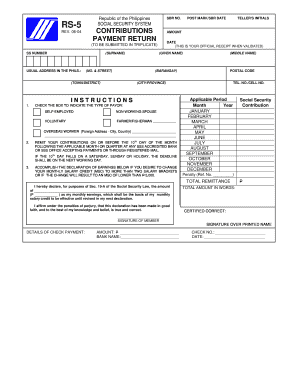

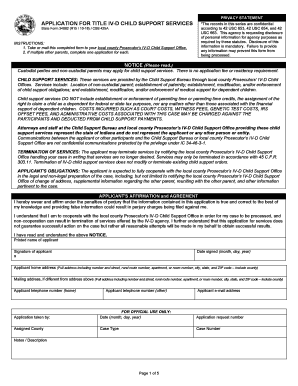

Republic of the Philippines RS-5 SOCIAL SECURITY SYSTEM CONTRIBUTIONS PAYMENT RETURN 06-2012 Please read the instructions below before accomplishing this form. Print all information in capital letters and use black ink only. 3. Make all checks payable to SSS and fill out properly the Details of Check Payment portion of the form. 4. SURNAME SS NUMBER NAME THIS IS YOUR OFFICIAL RECEIPT WHEN VALIDATED GIVEN NAME NO. STREET BARANGAY TOWN/DISTRICT ADDRESS CITY/PROVINCE MIDDLE NAME TYPE OF PAYOR...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sss payment form

Edit your sss payment slip form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sss rs 5 form pdf download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sss payment form voluntary online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sss payment slip 2025 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH RS-5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sss payment slip form

How to fill out PH RS-5

01

Obtain the PH RS-5 form from the official governmental website or office.

02

Fill in the personal information section with your full name, address, and contact details.

03

Enter your taxpayer identification number (TIN) if applicable.

04

Indicate the type of income you are reporting.

05

Provide the details of your income for the relevant period.

06

Attach any necessary documentation to support your income claims.

07

Review the form for completeness and accuracy.

08

Sign and date the form before submission.

Who needs PH RS-5?

01

Individuals who are required to report their income for tax purposes.

02

Freelancers and self-employed individuals needing to declare their earnings.

03

Business owners who need to file income and business-related taxes.

04

Anyone receiving income not subject to automatic withholding tax.

Fill

ph rs 5 1998 about sss form contributions payment

: Try Risk Free

People Also Ask about sss form rs 5

How can I get my SSS form online?

How can I get SSS E1 form? If you're already an SSS member and you want to get a copy of your E1 form, you can request for it online through the SSS member portal; no need to visit their office to request your personal record. After a few months, you will receive a digital copy of your original SSS E1 form via email.

How can I pay my SSS from abroad?

3 Ways to Pay Your SSS Contributions while Working Abroad Pay via Bank Auto-debit Programs. Pay via Over the Counter Procedure – Banks, Bayad Centers and Remittance/Money Exchange Centers. Have a relative or family member pay for your contributions locally.

How much is the SSS payment for OFW 2022?

The minimum compensation range for OFW contribution is ₱8,250 which has premium payment set to ₱1,040. While the maximum contribution range based on monthly salary is ₱24,750 and over which has a premium payment set to ₱3,250.

How can I get my SSS online copy?

If you're already an SSS member and you want to get a copy of your E1 form, you can request for it online through the SSS member portal; no need to visit their office to request your personal record. After a few months, you will receive a digital copy of your original SSS E1 form via email.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sss payment slip form for voluntary from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your r5 sss into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the who should use the ph filipino workers and voluntary members electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the sss payment slip 2025 pdf download in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your sss contribution form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is PH RS-5?

PH RS-5 is a tax form used in the Philippines for reporting certain income and deductions for individuals and businesses.

Who is required to file PH RS-5?

Individuals and businesses earning taxable income in the Philippines are required to file PH RS-5.

How to fill out PH RS-5?

To fill out PH RS-5, taxpayers must provide their personal information, details about their income, deductions, and any applicable credits, following the instructions provided by the Bureau of Internal Revenue.

What is the purpose of PH RS-5?

The purpose of PH RS-5 is to facilitate the reporting of income and calculation of tax obligations for taxpayers in the Philippines.

What information must be reported on PH RS-5?

The information that must be reported on PH RS-5 includes personal identification details, types and amounts of income received, allowable deductions, and any taxes previously paid or withheld.

Fill out your PH RS-5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

rs5 Form Sss is not the form you're looking for?Search for another form here.

Keywords relevant to sss voluntary payment form

Related to sss contribution payment form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.